Industrial Capacity & Margin Unlocks

For CXOs Who Need to Drive AI Outcomes This Quarter, Not Next Year.

Learn to spot €5-20M in hidden opportunities by working on your operations - in 30 days - through Pattern Recognition. Drive new Capacity - Margin - Internal Funding.

“Use this space to share reviews from customers about the products or services offered.”

Find margin leaks in maintenance, quality, throughput, and supplier patterns. You already produce the data exhaust across the business. We will show you how to convert it into value that hits the P&L and business decision making...fast.

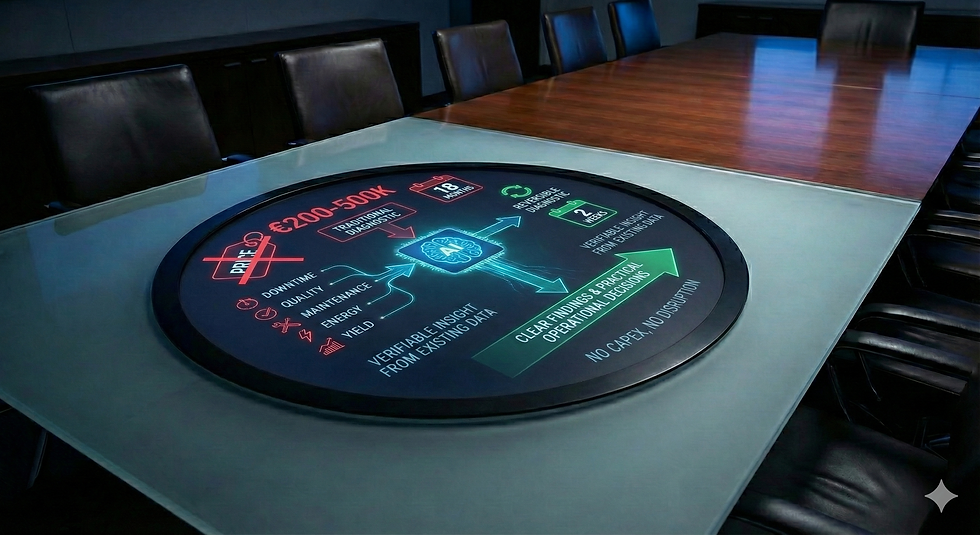

What used to take €200–500K and 18 months can now be done as a small, reversible diagnostic that delivers clear findings in two weeks. You already generate the raw material—downtime, quality, maintenance, energy and yield—and that data is an asset you have already paid to create. Modern AI can analyse it far faster, across more variables, with less friction, to surface patterns that translate into practical operational decisions. The advantage is not theory or transformation: it is verifiable insight from your existing data, delivered in weeks rather than years, with no capex and no disruption.

In practical terms, you already produce a continuous stream of operational evidence—downtime reasons, maintenance interventions, quality deviations, energy consumption, yield losses, batch and shift variation, supplier lots, and operator notes. Historically, converting that into P&L outcomes required specialist effort, slow data integration and expensive pilots, so the organisation defaulted to partial analysis and long proof cycles. Today, modern AI can interrogate those same datasets faster, across more variables, and with less manual overhead, making high-quality diagnostics viable at a fraction of the historic cost.

This is where the exponential curve matters: as capability rises and price falls, the threshold for “worth doing” drops sharply. You can test more hypotheses, more often, without asking for new capex or disrupting operations. The focus becomes disciplined value extraction: identify the patterns that drive margin leakage and throughput constraints, quantify the euro impact, and prioritise changes that convert into EBITDA—reduced scrap and rework, fewer unplanned stops, improved energy efficiency, better maintenance timing, and higher yield stability.

The board-level implication is simple. When the incremental cost of analysis becomes small and the speed of insight compresses from months to weeks, the risk shifts. The downside is limited to the diagnostic spend and management attention; the upside is recurring P&L improvement from assets you already own. This is not adopting technology for its own sake. It is using a rapidly improving capability curve to pull forward operational truth and convert it into margin and capacity—while others wait for “proof” and arrive when the advantage has become a commodity.

.png)